Vital Actions to Use and acquire Bid Bonds Properly

Navigating the complexities of quote bonds can significantly impact your success in protecting agreements. To approach this efficiently, it's important to comprehend the basic actions involved, from gathering required paperwork to selecting the appropriate guaranty company. The trip starts with organizing your financial statements and an extensive profile of previous projects, which can demonstrate your dependability to prospective sureties. Nevertheless, the genuine difficulty exists in the careful option of a trustworthy service provider and the calculated application of the bid bond to enhance your one-upmanship. What adheres to is a more detailed consider these vital stages.

Understanding Bid Bonds

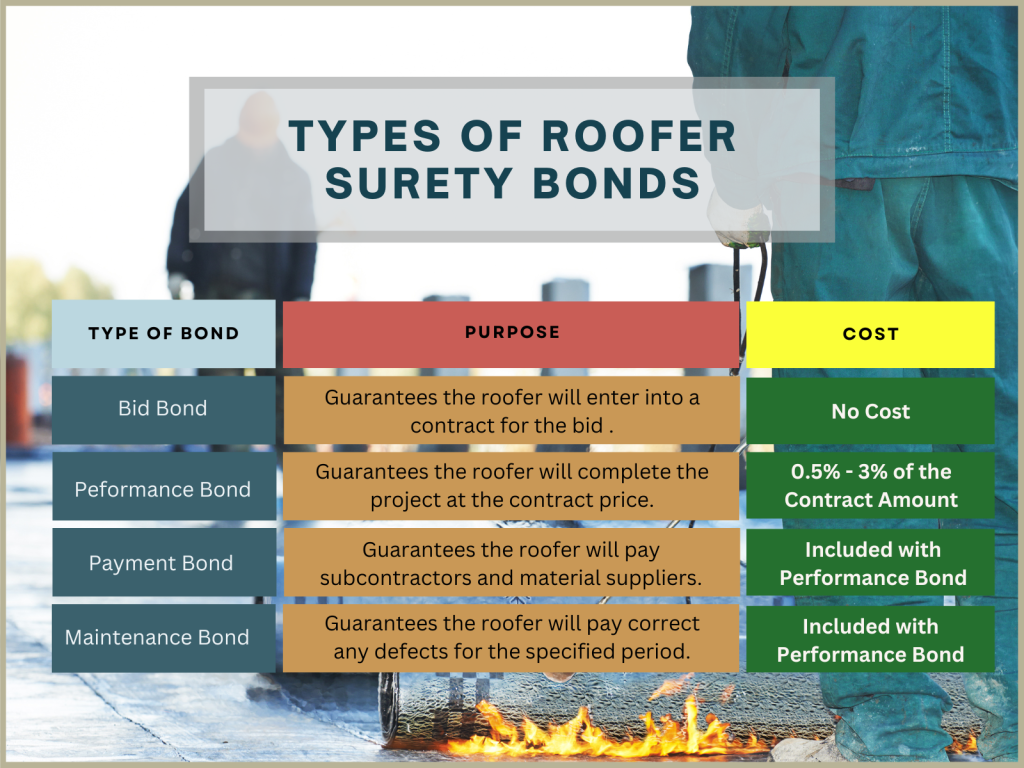

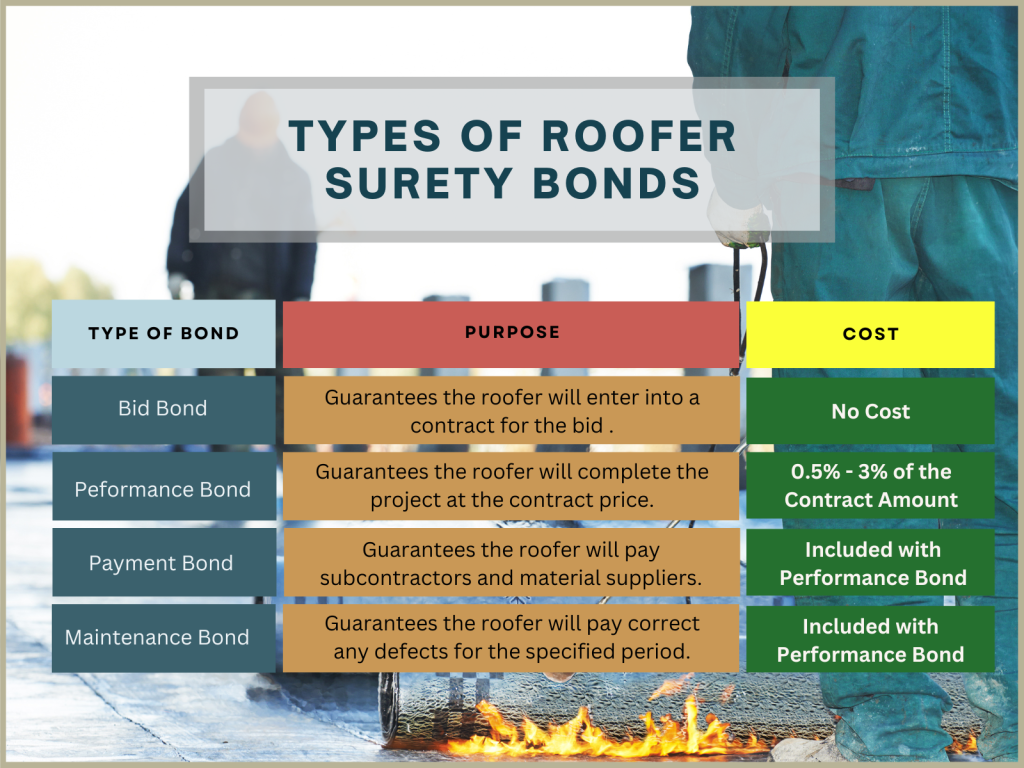

Quote bonds are an essential element in the building and construction and having industry, acting as a monetary assurance that a bidder means to become part of the contract at the bid rate if granted. Bid Bonds. These bonds minimize the threat for task owners, guaranteeing that the selected contractor will certainly not only recognize the quote but likewise safe and secure efficiency and payment bonds as required

Basically, a quote bond works as a secure, securing the job owner versus the monetary effects of a contractor stopping working or withdrawing a proposal to commence the job after selection. Normally provided by a surety firm, the bond warranties payment to the owner, typically 5-20% of the bid amount, must the service provider default.

In this context, proposal bonds foster an extra credible and affordable bidding process atmosphere. They oblige specialists to present sensible and significant proposals, knowing that a financial penalty looms over any breach of commitment. Furthermore, these bonds make sure that just solvent and reputable professionals take part, as the extensive certification process by surety business screens out less reputable bidders. Subsequently, bid bonds play an important duty in keeping the stability and smooth procedure of the building bidding process.

Planning For the Application

When preparing for the application of a proposal bond, meticulous company and detailed paperwork are vital,. An extensive review of the project requirements and proposal demands is important to ensure conformity with all terms. Start by assembling all needed financial declarations, consisting of equilibrium sheets, income declarations, and money circulation statements, to show your firm's financial health. These records must be existing and prepared by a licensed accountant to boost integrity.

Next, assemble a list of past jobs, particularly those similar in scope and size, highlighting successful completions and any distinctions or certifications received. This plan supplies an all natural sight of your firm's strategy to project execution.

Make certain that your organization licenses and registrations are easily available and up-to-date. Having these records arranged not only quickens the application process yet likewise predicts an expert image, instilling self-confidence in potential guaranty providers and job proprietors - Bid Bonds. By systematically preparing these elements, you position your firm favorably for effective bid bond applications

Discovering a Guaranty Supplier

A guaranty company acquainted with your field will certainly much better understand the unique threats and requirements associated with your jobs. It is additionally a good idea to evaluate their monetary ratings from firms like A.M. Best or Requirement & Poor's, guaranteeing they have the financial stamina to i thought about this back their bonds.

Involve with several providers to contrast solutions, terms, and rates. A competitive examination will certainly aid you secure the most effective terms for your proposal bond. Ultimately, a complete vetting procedure will guarantee a reputable collaboration, cultivating self-confidence in your bids and future projects.

Sending the Application

Submitting the application for a quote bond is a vital step that needs precise focus to detail. This procedure starts by gathering all appropriate documents, consisting of economic statements, job specifications, and a detailed business background. Ensuring the accuracy and efficiency of these files is extremely important, as any discrepancies can result in hold-ups or rejections.

When filling up out the application, it is a good idea to verify all entrances for precision. This includes confirming figures, guaranteeing appropriate signatures, and confirming that all necessary attachments are consisted of. Any kind of mistakes or noninclusions can weaken your application, causing unnecessary complications.

Leveraging Your Bid Bond

Leveraging your proposal bond efficiently can dramatically enhance your affordable side in securing agreements. A bid bond not only shows your economic stability however additionally assures the task owner of your commitment to meeting the agreement terms. By showcasing your bid bond, you can highlight your company's reliability and reputation, making your bid stick out amongst numerous competitors.

To take advantage of your proposal bond to its greatest potential, ensure it is provided as component of a thorough proposal package. Highlight the strength of your surety supplier, as this mirrors your firm's financial health and wellness and operational capability. In addition, stressing your performance history of successfully completed projects can even more impart confidence in the job owner.

Furthermore, preserving close communication with your surety supplier can promote far better terms in future bonds, hence enhancing your affordable placing. An aggressive strategy to handling and restoring your quote bonds can likewise stop gaps and make certain continual insurance coverage, which is critical for ongoing task procurement initiatives.

Verdict

Effectively obtaining and making use of proposal bonds necessitates comprehensive preparation and critical implementation. By thoroughly arranging crucial paperwork, picking a respectable surety provider, and sending a full application, companies can protect the needed their website proposal bonds to enhance their competition.

Recognizing a trusted guaranty service provider is an important action in securing a bid bond. A quote bond not only shows your economic security yet also reassures the job owner of index your dedication to satisfying the agreement terms. Bid Bonds. By showcasing your proposal bond, you can underscore your company's reliability and integrity, making your proposal stand out amongst countless rivals

To utilize your proposal bond to its greatest possibility, guarantee it is offered as component of a thorough proposal plan. By adequately arranging crucial paperwork, choosing a trustworthy guaranty copyright, and sending a total application, firms can secure the required bid bonds to boost their competition.